BC Budget 2015 confirms it: we can afford the $10aDay Child Care Plan

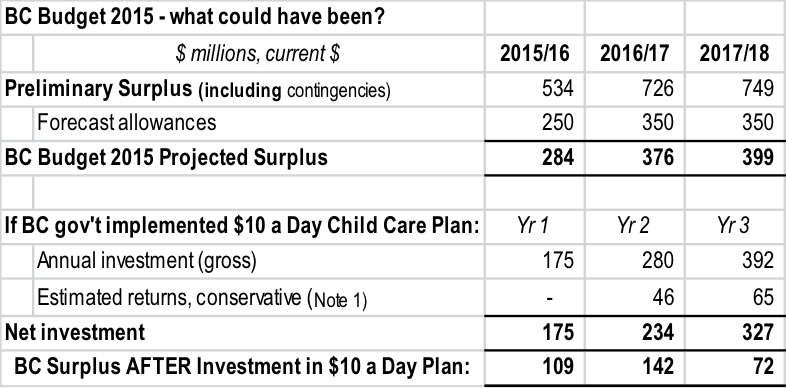

Budget 2015 clearly shows that BC can afford to start implementing the $10aDay Child Care Plan now – and it can choose to do so without raising taxes, without cutting vital programs and services, and without going into deficit. A short and simple analysis, summarized below, provides one example of how investment in child care could be gradually introduced. With implementation phased in over 10 years and very conservative estimates of early returns to government, BC can still achieve surpluses throughout the budget period – surpluses which could also be used to enhance other services.

The CCPA is currently researching various implementation and financing options for the $10aDay Child Care Plan and I look forward to having detailed analysis and proposals. Given the experience in this fiscal year, where BC’s original budgeted surplus of $184 million is now closer to $1 billion, we may have even more surplus funds to work with in the future. And, there is the potential for new federal contributions after the upcoming federal election, making child care even more affordable for BC and/or raising the possibility that we could ramp up our implementation schedule and provide more relief to families sooner.

Still, Budget 2015 on its own confirms that the BC government’s only stated excuse for not implementing the $10aDay Plan – “we can’t afford it” – is officially eliminated, along with budget deficits for the foreseeable future.

Note – Generation Squeeze estimates various benefits from $10 a day child care. For example, 38% of total costs are returned to government in taxes paid by ECEs earning pay equity wages and more mothers in paid labour force. Early in implementation, benefits in table above are conservatively estimated at 33% of 50% of annual investment, as access and ECE wages increase (in addition to lower parent fees).