Correcting the Fraser Institute’s crude assumptions

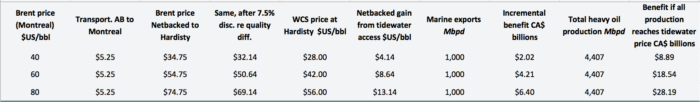

The Fraser Institute’s new report, The Costs of Pipeline Obstructionism, claims that lack of new export pipelines to tidewater is costing Canada $2.02–$6.4 billion dollars per year (depending on the assumed oil price). The authors offer the following table, based on exports via the proposed Energy East pipeline, as evidence (Table 1 from page 10 of the report):

The authors make several flawed assumptions to “prove” their point (see also footnotes for this table in the report). For example:

- They incorrectly assume the world “Brent” oil price in Montreal will be on par with the North American “WTI” oil price in Cushing, Oklahoma, against which Western Canadian crude (the WCS benchmark) is now sold. The final destination of the Energy East pipeline is St. John, New Brunswick, not Montreal (Montreal area refineries are already well served with Western Canadian crude thanks to the recent reversal of Line 9 between Sarnia and Montreal). At St. John most of the oil will be loaded on tankers and sold overseas. Hence the price received in Montreal is highly likely to be considerably below the WTI price at Cushing given the additional transportation costs to St. John to access international markets.

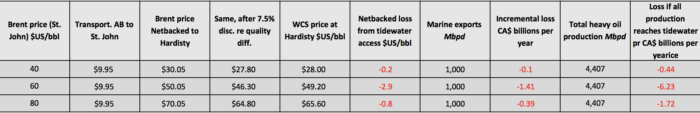

- They assume it will be cheaper to move oil to Montreal than to Cushing despite the fact the toll for moving oil through pipelines is a function of distance. The distance from Hardisty, Alberta to Cushing, Oklahoma (2,600 km) is considerably shorter than Hardisty to Montreal (3,400 km). The toll to Cushing in May 2015 was US$5.75/barrel, yet the authors assume the per-barrel toll to Montreal would be US$5.25. The correct toll to Montreal based on distance is US$7.52/barrel. To move the oil to St. John to access international markets and the Brent price (a distance of 4,500 km from Hardisty) it would cost US$9.95/barrel.

- They underestimate the price that can be obtained at Cushing as oil prices rise. The authors assume the discount for WCS at Cushing will be 30%, even at higher oil prices. (The Canadian WCS benchmark always sells at a discount to WTI or Brent as its heavy, high-sulphur characteristics make it less valuable to refiners; this discount also includes transport costs from Hardisty to Cushing). Although a discount of 30% is reasonable at $40/barrel, at $60 and $80 the discount is about 18% based on data from January 2009 to April 2016. Furthermore, refineries at which WCS is sold must be set up to handle heavy oil, and U.S. Gulf Coast refineries are the largest market in the world for heavy oil. Thus there is no guarantee that WCS sold overseas would not be even more deeply discounted than WCS at Cushing, as there are a limited number of refineries outside the U.S. to handle it.

- The Brent-to-WTI differential, which caused the enthusiasm for tidewater access, has almost disappeared due to the construction of pipelines in the U.S. to relieve the bottleneck between Cushing and the Gulf Coast. The differential averaged just 75 cents per barrel from January to June 2016. Hence WCS oil that is exported from St. John is unlikely to command any premium to WTI when the cost of tanker shipment to international markets is included.

Correcting the authors’ Table 1 below shows the Energy East pipeline is a money-losing proposition, particularly considering that the capacity is not needed given the cap on Alberta oil sands emissions and Canada’s commitments under the Paris Agreement. Losses at $60/barrel will total $1.41 billion per year from Energy East. And losses could be even higher given the limited availability of overseas refineries that can handle heavy Canadian crude, necessitating even steeper discounts.

The authors do, however, correctly point out that royalties from oil in Alberta and Saskatchewan have plummeted as a result of the collapse in oil prices, even as production rises. They then go on to say that new tidewater-access pipelines would increase the royalty take based on their calculations of increased prices. In fact, the opposite is true, given there is a net decrease in the oil price received through tidewater exports via Energy East if realistic assumptions are used.

The Fraser Institute report is a flawed analysis and should not be taken seriously in deliberations on the need for new export pipelines to tidewater or in the development of Canada’s climate plan to meet its Paris Agreement commitments.

A version of this post was published on the CCPA National Office blog, Behind the Numbers.

Topics: Climate change & energy policy, Environment, resources & sustainability