BC’s housing crisis during the pandemic: A snapshot

BC has long been in a housing crisis, and the pandemic economy we are currently living in has further put the squeeze on renters in particular. To shed light on the housing situation during this crisis, we draw on new data from a comprehensive survey of 2,289 residents across the province, conducted online by McAllister Research from May 16 to June 1, 2020.

The data make clear that British Columbians are hurting financially, but public support programs like the CERB and BC’s Temporary Rental Supplement are helping significantly, ensuring far fewer people are left unable to pay their rent or mortgages than would otherwise have happened and compared to in the United States, for example. Without this type of critical public investment to take care of each other during the crisis, the consequences for British Columbians would have been disastrous. But the ongoing hardship is real, and it’s clear that ongoing support is needed along with more action for those falling through the cracks of current programs.

Encouragingly, polling shows that there is strong public support for additional bold policies that tackle the pre-existing housing crisis in BC, as well as for continued emergency measures like the ban on evictions for non-payment of rent and freeze on rent increases. For more on how British Columbians see the broader COVID-19 policy landscape, see our separate analysis. Unfortunately, the provincial government recently announced plans to lift the eviction ban as of September 1, when BC’s rental supplement is also scheduled to end. Both should be extended.

Pandemic impacts on renters and owners

The survey data show that many households in BC entered the pandemic in a precarious financial state and have taken further hits from the sharp economic downturn. Among renters, 54 per cent report loss of income in their households, compared with 48 per cent of owners with mortgages and 27 per cent of owners without mortgages. For those renters facing household income loss, about two thirds were hit with either temporary layoff or job loss (the other third experienced reduction in work hours, reduced business income, or other loss). Renters also reported the highest severity of income loss. One third of renters losing income report a loss of 60 per cent or more.

The survey data show that many households in BC entered the pandemic in a precarious financial state and have taken further hits from the sharp economic downturn.

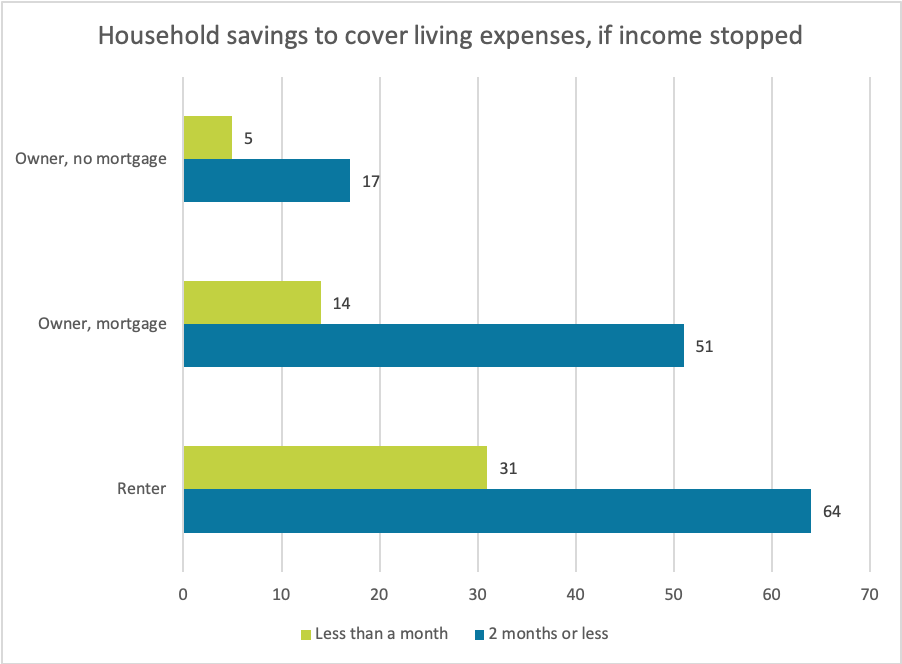

Respondents were also asked about the savings they have to cover bills and necessities if their incomes stopped entirely today. Again, renters were by far the most financially precarious, with nearly one third saying they had less than a month’s savings to survive on, and nearly two thirds had two months savings or less. In contrast, the vast majority of owners without mortgages reported having three months savings or more, and 42 per cent reported having a year’s savings or more. Owners with mortgages fell in between these two groups in terms of their level of savings.

Overall, 72 per cent of renters say they are just getting by or falling behind financially, and 60 per cent of owners with mortgages say the same (conversely, 70 per cent of owners without mortgages are financially secure or getting ahead).

A picture of renters and landlords in BC

The survey data affirms some things we already know: there is a clear class difference between renters and owners in BC. Renters in the survey reported having much lower incomes, including nearly two thirds with household incomes under $60,000, compared to owners with mortgages (27 per cent reporting under $60,000 household income).

Though renters tend to be younger on average, over a quarter of the survey respondents aged 65 or older were renters. In addition, while they are especially likely to live in Metro Vancouver, renters make up a significant share of the population in every region of BC. Clearly, housing security is a big concern for younger people in bigger centres, but it would be a mistake to assume that these concerns don’t extend across age groups and around the province.

The survey data affirms some things we already know: there is a clear class difference between renters and owners in BC.

Notably, only a minority of respondents (22 per cent) said they pay their rent to “a homeowner who lives in the same building”, with the remaining renters paying corporate and other investor landlords. As CCPA analysis has shown, struggling homeowners are not your typical landlord.

The impact of pandemic supports, including BC’s rental supplement

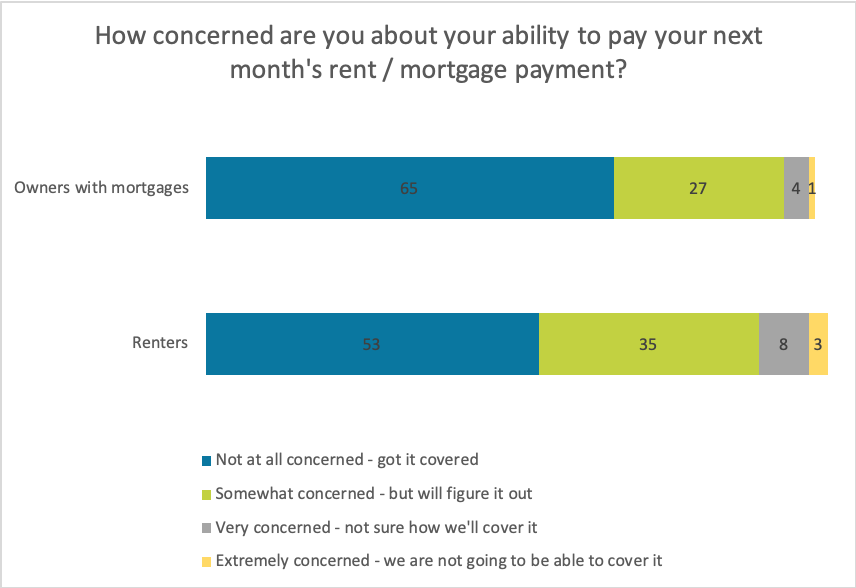

The good news is that government supports seem to have been working for many households. Among renters, 39 per cent said they had received COVID-related benefits from the federal or provincial government, and 88 per cent of renters reported being able to pay their May rent in full. The BC government previously reported over 80,000 eligible applications for the province’s rental supplement as of late June. But some renters are still in dire straits: 10 per cent of renters reported paying only partial rent in May and another 2 per cent couldn’t pay at all. In a forward-looking question, 11 per cent of renters said they were either very or extremely concerned about making rent in the following month, and another 35 per cent said they were somewhat concerned but would figure it out.

Renters who were very or extremely concerned about making rent were also more likely to be part of a visible minority group (other than Indigenous people) and tended to be younger, skewing to the 18-49 age group.

What about that group of renters who are still struggling most, despite the support programs that have been rolled out? Are they accessing BC’s Temporary Rental Supplement? As mentioned, the group of renters in our survey who were still very or extremely concerned about making the next month’s rent made up 11 per cent of all renters. More than half of this struggling group said they did not attempt to access the renter supplement. Why didn’t they apply? Most of this subgroup said they either didn’t know about the supplement (46 per cent) or believed they weren’t eligible for it (40 per cent). In the latter case, they may be ineligible due to receiving social assistance or living in existing subsidized housing, or because their 2019 income was above the threshold ($74,150 for those without dependents). (Respondents to the survey were not asked to provide the specific reason they believed they were ineligible.)

Renters who were very or extremely concerned about making rent were also more likely to be part of a visible minority group (other than Indigenous people) and tended to be younger…

The majority of this subgroup (struggling renters who did not apply for BC’s rent supplement) had household incomes under $40,000. This is consistent with a long-standing problem: “opt-in” social programs often fail to reach many of the very low income folks they are intended to assist. This is why it’s typically better to design social programs with automatic enrolment, particularly when the purpose is to help people with low incomes or who are otherwise marginalized.

While owners are generally better off than renters, some remain in a precarious position. Five per cent of those with mortgages were very or extremely concerned about making their next payment (and another 27 per cent were somewhat concerned, but said they would figure it out).

British Columbians support for bold action on housing

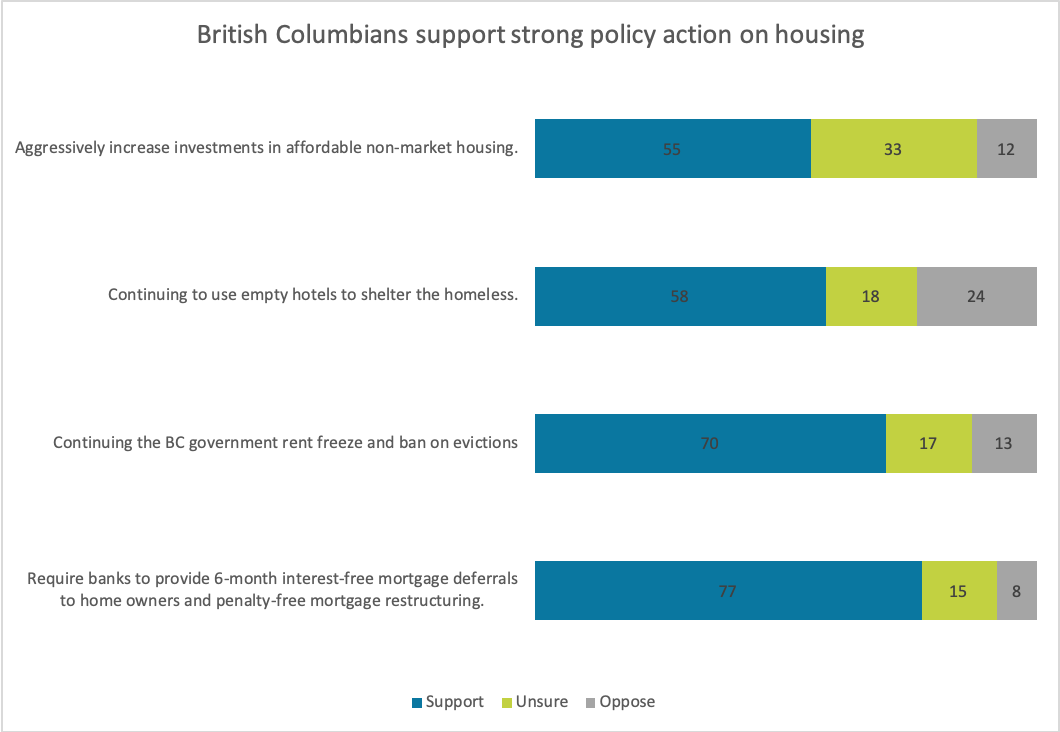

Another striking dynamic relating to housing stands out in the survey. British Columbians as a whole express clear support for bold policies to address the housing crisis in the wake of the pandemic.

First, there is overwhelming support for the BC government continuing the rent freeze and ban on evictions, with 70 per cent of British Colombians in support compared to only 13 per cent opposed. In addition, 55 per cent support taking steps to “aggressively increase investments in affordable non-market housing”, with only 12 per cent opposed. And 58 per cent support “continuing to use empty hotels to shelter the homeless.” In each case, renters supported these measures even more strongly. More than three quarters of British Columbians also supported requiring banks to provide six-month interest-free mortgage deferrals.

British Columbians as a whole express clear support for bold policies to address the housing crisis in the wake of the pandemic.

A strong case for income supports, renter protections, and housing investments

As the pandemic unfolded, public support programs like the CERB and provincial rental supplement offered a crucial lifeline and will continue to be needed going forward, including an overhaul of the inadequate Employment Insurance system before emergency benefits like CERB end. These benefits appear to be why most BC renters have been able to make their rent during the crisis. The current plan to end the renter supplement, along the eviction ban, should be reversed. For their part, landlords would do well to focus their energy on advocating for continued and stronger income and rental supports rather than opposing the ban on rent-related evictions.

But even with these measures in place, it’s clear that some are falling through the cracks. A segment of struggling renters is not effectively accessing the rental supplement. This underscores the importance of expanding the rent supplement eligibility, as well as keeping the ban on evictions for non-payment of rent in place. Landlords, as ongoing beneficiaries of high rents and property values, should also share some portion of the costs of the crisis, rather than renters having to cover months of deferred rent. In the government’s recently announced repayment plan framework, beginning October 1, landlords can require renters to begin paying back all missed rent gradually by July 2021, even as the rental supplement is set to end. Renters will no longer be protected from evictions for missing rent or missing repayments of deferred rent.

These benefits appear to be why most BC renters have been able to make their rent during the crisis.

As the pandemic continues, a huge number of households—renters in particular—remain under major financial strain even if most are managing to cover rent and mortgage payments for now. Fortunately, there is strong public support for bold policy action in response to the crisis, including backing for an aggressive expansion of non-market housing, continuing the eviction ban and rent freeze, and taking urgent action to provide homes for people without them. The important policy steps taken in the early months of this crisis must not be wound down prematurely, but rather they need to be reinforced, improved and expanded. On housing and many other fronts, we need to use public policy to take care of each other in this province. Failing to do so would cause serious economic and social damage for years to come.

—

This post is the second in a series looking at results from a comprehensive survey of British Columbians about their experiences of the pandemic, and is part of an ongoing research project funded by the Vancouver Foundation. Access the first and third posts.

SURVEY METHODOLOGY

McAllister professional staff are accredited members of ESOMAR, the international professional body for public opinion research and market intelligence.

The questions asked as a part of this survey that relate to the data shared in this post are available here.

Topics: COVID-19, Housing & homelessness