The real impact of HST’s defeat on provincial finances

On Sept 8, Finance Minister Kevin Falcon released a much anticipated update on provincial finances.

The Minster’s presentation focused on highlighting the cost of the move back to PST/GST, providing some large numbers for the media headlines, instead of looking at the big picture.

In case you missed the media coverage, the provincial coffers are projected to suffer a loss of $2.8 billion over the next 3 years, relative to the estimates presented in February’s Budget 2011. The Ministry estimates that $2.3 billion of the loss is brought about by the HST defeat and the move back to the PST/GST system.

The Minister argued the impact of the HST defeat is manageable, but warned that:

“We’re going to be very tough on operating expenditures and people need to understand it is going to be a government that is going to be run very, very tightly from a fiscal point of view.”

However, closer look at the numbers reveal that the provincial financial situation is not nearly as dire as it may seem. And that returning to PST/GST is not all that costly, when compared with how much it would have cost to keep the “fixed” HST.

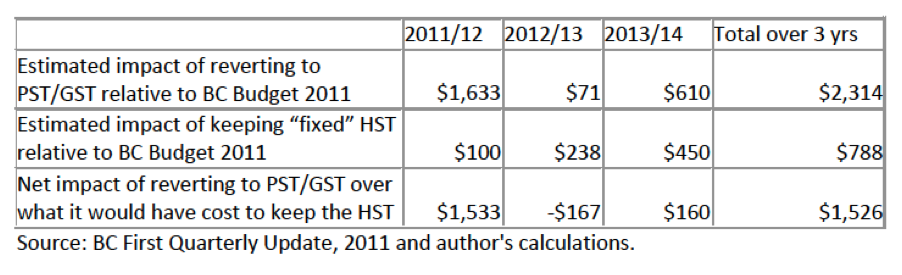

Firstly, comparing the costs of repealing the HST to the February budget estimates is misleading. Budget 2011 numbers did not include the cost of the last minute HST “fix” that Premier Clark announced this summer. Keeping the HST would have involved a significant budget loss relative to the numbers announced in February, as Seth Klein pointed out here. This is why the impact of reverting to PST/GST should be compared to the impact of keeping the “fixed” HST.

The cost of the one time rebates of $175 per child regardless of family income and for low- and modest- income seniors were estimated at $200 million. The government’s news release announced that these checks would go out before the end of the year, so they should be considered as expenses in 2011/12.

In addition, the HST was slated to be reduced to 11% in July 2012, which would have cost the government around $638 million in 2012/13 — 3/4 of the annual cost of a 1 percentage point reduction (estimated at $850 million). In 2013/14 the government would have given up $850 million. And this isn’t even considering that in July 2014, the tax was going to be reduced to 10%, giving up a total of $1.7 billion in revenues every year. At that rate, the government’s actually going to be collecting more revenue with the PST/GST than otherwise.

Some of these extra costs would have been offset by the increase in the corporate income tax to 12% (from the current 10%) in January 2012 and by postponing the small business tax cut slated for April 2012. These would have generated an additional $100 mil in 2011/12 (1/4 of the annual revenue gain, estimated at $400 mil) and just over $400 million each in 2012/13 and 2013/14.

Thus, the real comparison of the costs of repealing the HST looks more like this:

My analysis shows that the provincial treasury would have faced a shortfall of $800 million even if the HST had survived the referendum. The real net costs of reverting to PST/GST are $1.5 billion, not $2.3 billion.

Of course, using the bigger number is more effective if one were looking to lay the blame for provincial fiscal challenges onto the referendum results.

Now, let’s turn to the total provincial fiscal position. Many analysts/commentators seem to have forgotten that the fiscal plan features unusually large contingencies and forecast allowances over the next 3 years. These total $2.5 billion over the 3 years and thus entirely cover the costs of the HST reversal.

If the HST defeat is not an unexpected event worth dipping into the contingency funds for, I don’t know what is.

As for the forecast allowance, the government has already built a lot of prudence into the budget projections by using economic growth forecasts that are considerably lower than the private sector consensus forecast (2% vs 2.8% growth for 2011 and 2.3% vs 2.8% growth in 2012).

In other words, the BC government has a real fiscal gap of only about $300 million over 3 years relative to Budget 2011, not $2.8 billion. This is a lot more manageable and hardly requires the kind of tight-fisted approach advocated by Minister Falcon.

Some of the media commentary around the fiscal update, such as Vaughn Palmer’s piece in the Sun are suggesting that the BC government is using the current fiscal challenges as an opportunity to punish British Columbians for exercising their rights in the HST referendum. This would be a great mistake. Not only would it go against our country’s respect for democracy, but it would also put a drag on the already fragile recovery (latest job numbers released today show BC is shedding jobs, full-time jobs in particular).

Topics: Economy, Provincial budget & finance, Taxes, Transparency & accountability