Reality check: BC government can afford to make more investments in urgent social and environmental priorities

BC has the economic means to increase public investments and more fulsomely tackle big challenges facing British Columbians in areas like poverty, housing, health care and the climate crisis.

While some big business lobby groups and commentators are trying to raise alarms about BC government spending and finances, the latest numbers show there is room to do substantially more. In fact, spending levels still haven’t recovered after huge cuts by the previous BC Liberal government, despite the growing need for social investments.

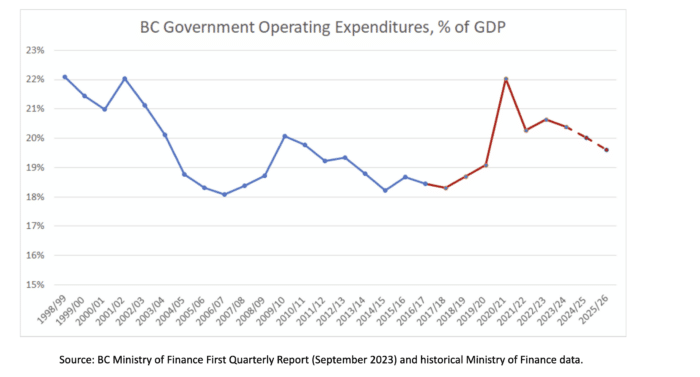

The latest report on provincial finances shows that provincial government operating spending, as a share of our overall economic output (or GDP), remains well below the levels of 25 years ago.

At the turn of the century, provincial operating spending hovered around 21.5% of GDP. This figure plummeted to around 18.5% after the BC Liberal government took office in 2001 and rapidly made deep cuts to social spending and brought in tax cuts that disproportionately benefited the rich.

Despite a partial recovery after the BC NDP took office and a real need to increase spending at the height of the pandemic, spending as a share of GDP remains well below levels at the turn of the century. In the current fiscal plan, provincial operating spending as a share of GDP is projected to be 20.4% this year and is expected to fall further to 19.6% by 2025/26.

If provincial spending in 2023/24 returned to the levels of 25 years ago as a share of GDP, we’d have an additional $4.3 billion available to invest in priority areas in this year alone (and rising each year). By 2025/26, we’d have an additional $8 billion available above current spending projections for that year.

These figures likely understate the gap since I have assumed that large unallocated contingency funds in BC’s budget (approximately $5 billion in each of the next three years) will at some point be allocated and spent in full. If they aren’t, then spending as a share of GDP will be lower over the next three years and the gap compared to earlier spending levels will be even wider.

Spending as a share of GDP is a useful measure because it tells us about our overall, long-term economic capacity for greater investment in the public good. If we want to make more badly needed investments in social and environmental priorities, this helps show that we have the economic capacity to do so.

Despite the long-term decline in spending as a share of GDP, some lobby groups and commentators always seem to be painting a picture of “big spending” by the provincial government. One prominent pundit recently declared that “the NDP era is more about expanding government and spending, spending, spending” (though he also concludes that the public doesn’t seem to mind this approach).

The Business Council of BC says the government has “opened the spending tap” and warns against running deficits. The Greater Vancouver Board of Trade talks about a “high-spending budget” and calls for more business and commercial property tax cuts. In similar vein, opposition political leaders have variously characterized the provincial fiscal plan as “unconstrained spending”, “dangerous” and “spending money willy-nilly.”

While it is true the BC government is projecting deficits over the next three years, these are more than offset by the huge unallocated contingency funds and forecast allowances built into the fiscal plan, which together amount to $16.7 billion in fiscal padding over the same three years. So, we may be in store for the usual “surprise” improvements in deficits over time.

If provincial spending in 2023/24 was as a share of GDP 25 years ago we’d have an additional $4.3 billion available to invest in priority areas this year alone.

Credit rating agencies like Moody’s recognize this, noting the “high levels of contingencies and conservative economic and fiscal forecasts built into the budget projections which provide significant cushion against unanticipated challenges.” Moody’s is also quite sanguine about BC’s overall fiscal position, noting the province’s “strong debt affordability—despite the recent rise in interest rates—which compares favourably with domestic and global peers.”

Running deficits is entirely appropriate amid a softening economic outlook. Deficits are also far preferable to inadequate investment in critical public services and infrastructure, which has led to its own kind of deficits—social and environmental—over decades.

Any eventual return to budget balance should come via increased revenue, not by neglecting public investment, which would be costly to BC’s social and economic well-being in the long run.

Fortunately, there are many options to raise additional government revenue in BC. Moody’s most-recent credit rating report notes: “British Columbia’s level of taxation is at the lower end of the Canadian provinces, providing flexibility to raise taxes if necessary while still remaining competitive with other jurisdictions.”

Given the high levels of income and wealth inequality in BC, a natural place to start would be to increase tax rates on ballooning land wealth, large corporations and the highest incomes.

BC is a prosperous province but an extremely unequal one. The decline in provincial spending as a share of GDP shows one of the reasons why: we’re now harnessing significantly less of our shared prosperity for investment in the public good than we once did. Rhetoric about “big spending” obscures this fact.

Inequality and underspending on services is far from inevitable. We need to tackle the big social and environmental challenges in front of us—housing, health care, child care, toxic drugs, poverty and climate change (to name a few)—and we have every ability to invest together to build a healthy, sustainable future for all British Columbians.

Topics: Provincial budget & finance, Taxes